Term Sheets Decoded: The Critical Document That Can Make or Break Your Startup Funding Deal

The Smart Founder’s Guide to Reading and Negotiating Term Sheets

When you're raising funds for your startup, the term sheet is the first official handshake—where intent becomes serious and the business marriage begins. It's not legally binding (yet), but make no mistake: the clauses, numbers, and promises laid out here can determine the future of your startup, your control, and even your success in future rounds.

In this deep-dive guide, we’ll break down what a term sheet is, why it matters, its purpose, types, timelines, and what founders must understand before signing anything. Whether you're eyeing VC funding, a bridge round, or a SAFE agreement, this is your go-to blueprint.

Table of Contents

- What Is a Term Sheet?

- Why a Term Sheet Matters

- The Purpose Behind a Term Sheet

- Key Types of Term Sheets Explained

- Key Elements of a Term Sheet

- Term Sheet Negotiation Strategies

- Common Mistakes Founders Make

- Final Thoughts: Read Before You Sign

What Is a Term Sheet?A Roadmap to Investment Reality

- A term sheet is an informal, non-binding document that summarizes the most important terms and conditions of a proposed investment agreement between an investor and a startup.

- It is a guideline for preparing legally binding agreements such as the Shareholders' Agreement and Investment Agreement.

- While not legally enforceable (with the exception of certain clauses such as confidentiality or exclusivity), it serves to inform both sides of the other's expectations, which guards interest and makes negotiations easier prior to making formal agreements.

- More than 80%-90% of VC transactions begin with a term sheet prior to formal legal agreements.

- Negotiating a term sheet usually takes 2–4 weeks, while legal closure may take an additional 4–8 weeks.

- 30–50% of term sheets are either declined or renegotiated because of unfavorable terms.

- The NVCA and the Y Combinator offer standardized term sheet templates that enjoy broad acceptance.

Why a Term Sheet Matters: More Than Just a Formality

Signing a term sheet is like defining the rules before playing the game. Here's why it matters deeply:

- Creates Sharp Expectations: Sets agreement upfront regarding valuation, equity, rights, and obligations for founders and investors.

- Reduces Misunderstandings: Lessens the potential for future disagreements by agreeing on critical terms prior to legal documents.

- Saves Time and Money: Accelerates negotiations and reduces legal fees by simplifying the due diligence and documentation process.

- Safeguards Both Parties' Interests: Protects founders against over-dilution and provides investors with certainty on returns and governance rights.

- Facilitates Deal Closing: Acts as a template that directs the drafting of binding documents such as the Shareholders' Agreement.

- Indicates Serious Intent: Presents commitment from both parties, fostering more trust and confidence in the deal.

- Sets Up Future Rounds: Places a clean, investor-friendly groundwork that facilitates subsequent fundraising more efficiently and professionally.

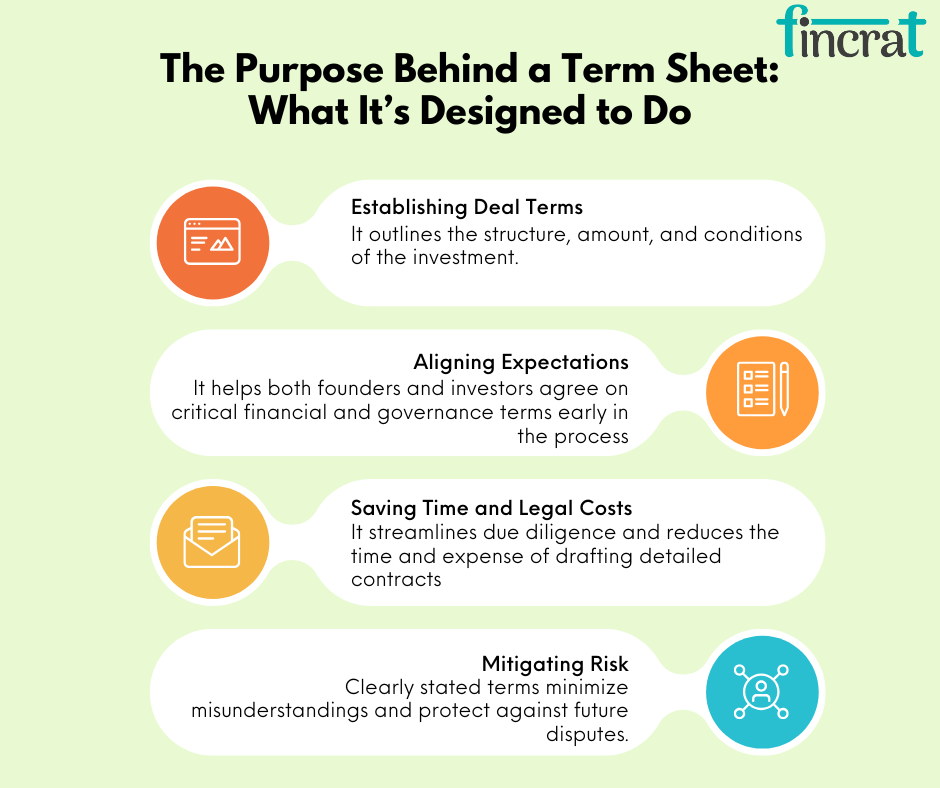

The Purpose Behind a Term Sheet: What It’s Designed to Do

The primary purposes of a term sheet include:

- Establishing Deal Terms: It outlines the structure, amount, and conditions of the investment.

- Aligning Expectations: It helps both founders and investors agree on critical financial and governance terms early in the process.

- Saving Time and Legal Costs: It streamlines due diligence and reduces the time and expense of drafting detailed contracts.

- Mitigating Risk: Clearly stated terms minimize misunderstandings and protect against future disputes.

Types of Term Sheets: Choosing the Right Path to Capital

Let’s look at the major types of term sheets used by startups today, with pros, use cases, and who it’s best for.

- Equity Term Sheet

- Convertible Note Term Sheet

- SAFE Term Sheet

- Debt Term Sheet

- Strategic Partnership Term Sheet

- Bridge Round Term Sheet

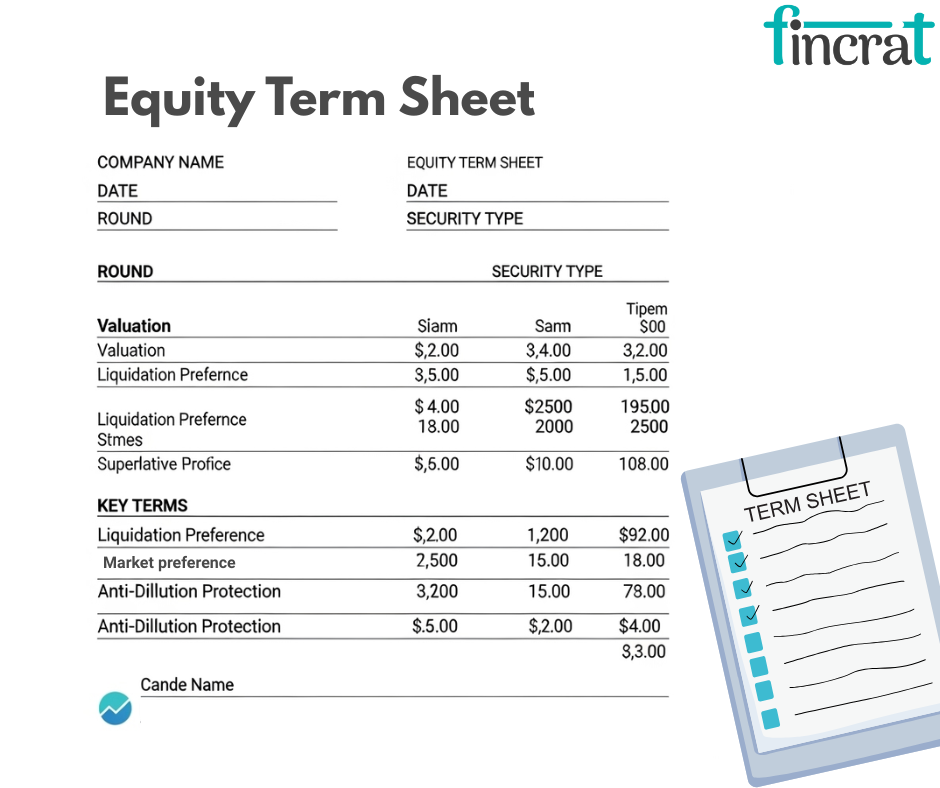

1.Equity Term Sheet

- It is the most prevalent one used in venture capital.

- It details the investor's capital for a certain percentage of equity in the startup.

- The valuation, equity stake, liquidation preferences, board rights, and anti-dilution clauses are the major components.

- Growth-stage startups looking for venture capital or strategic equity investment.

Pros:

- Investor is aligned with startup success

- No repayment obligation

Cons:

- Dilution of founder ownership

- More complex negotiation

2.Convertible Note Term Sheet

- Used in early-stage financing, this type enables investors to lend cash to a startup, which is subsequently converted into equity at a discounted value in the subsequent financing round.

- The terms are interest rate, maturity date, valuation cap, and discount rate.

- Startups requiring quick financing prior to determining a valuation.

Pros:

- Delays valuation to future round

- Simple, fast agreement

Cons:

- Debt on the books

- Can lead to future dilution

3.SAFE (Simple Agreement for Future Equity) Term Sheet

- SAFEs enable investors to invest in a startup in return for future equity without interest or maturity.

- It's easy and adaptable.Those early-stage startups that desire an easy funding arrangement with minimal legal complexity.

Pros:

- Extremely founder-friendly

No repayment pressure

Cons:

- No investor protections like notes

- Less negotiation flexibility

4.Debt Term Sheet

- Used when the investor lends money instead of purchasing equity.

- The term sheet outlines the amount lent, interest rate, repayment terms, covenants, and security

- Founders who do not want to give up equity but can afford to repay.

Pros:

- Founder retains full control

- Predictable repayment

Cons:

- Financial burden

- No strategic support from investors

5.Strategic Partnership Term Sheet

- This specifies terms when an investment is sought by a corporate or strategic partner for access to technology, markets, or exclusivity.

- It involves equity, intellectual property rights, board representation, or exclusivity provisions.

- Startups collaborating with large firms for capital as well as strategic advantages.

Pros:

- Opens doors to markets, tech, customers

- Credibility boost

Cons:

- Risk of dependency

- May limit future partnerships

6.Bridge Round Term Sheet

- Applied in bridge fundraising (between significant rounds), this term sheet provides working capital, sometimes through convertible notes or SAFEs, until a bigger round is raised.

- Startups in need of runway extension before a Series A/B raise.

Pros:

- Extends runway

- Avoids premature Series A/B

Cons:

- Temporary fix

- Adds complexity to next round

Key Elements of a Term Sheet

A term sheet typically contains several core elements that define the structure of the investment, the rights and responsibilities of the parties involved, and the future governance of the startup. Below are the most important elements, explained in detail:

1. Investment Amount

- It's the amount the investor is committing to invest into the company. It is the first line of the term sheet and will decide how much capital the startup receives against equity.

- Sets expectations and scope of the round. Resolves equity ownership on the basis of the valuation.

- Example: An investor is committing to invest ₹2 Crores into a startup.

2. Valuation (Pre-Money & Post-Money)

- Pre-Money Valuation: The valuation of the startup prior to the new investment.

- Post-Money Valuation: Pre-money valuation + amount of investment.

- Defines how much equity the investor will have and how much the founders will be diluted.

- Example: If pre-money valuation is ₹10 Crores and investment is ₹2 Crores, then post-money valuation is ₹12 Crores.

3. Equity Share

- Specifies what percentage of the company the investor will own after the investment.

- Formula: (Investment amount ÷ Post-money valuation) × 100

- Directly affects control, ownership, and dilution of current stakeholders.

4. Liquidation Preference

- Safeguards investors by allowing them to receive their money back (and more) ahead of common shareholders in the event of liquidation, acquisition, or sale.

- Types:

- Non-Participating: Investor receives 100% of investment back first, then nothing additional.

- Participating: Investors receive their money back plus a portion of remaining proceeds.

- Guarantees investor downside protection.

5. Anti-Dilution Protection

- Avants investor equity.rom being excessively diluted in subsequent financing rounds at lower valuations ("down rounds").

- Types:

- Full Ratchet: Converts existing shares to equal the new lower price.

- Weighted Average: Varies by amount and price of new shares.

- Promotes fairness or early investors in fluctuating valuations.

6. Board Composition

- Specifies who will be.on the company's board and how many seats.each party retains (founders, investors, independents).

- Example: A 5-member board with 2 places for founders, 2 for investors, 1 independent.

- Why it matters: Acts as a check on governance and strategic decision-making.

7. Voting Rights

- Grants some shareholders special voting rights or powers on major decisions, e.g., future fundraising, sale of the company, issuing new shares, or the hiring/firing of executives.

- Investors want to have a guarantee of being able to defend their stake and make strategic decisions.

8. ESOP Pool (Employee Stock Option Pool)

- Reserves a portion of equity for employee stock options. Usually must be included as part of the pre-money valuation, affecting founder dilution.

- Typical range: 10–15% of total equity.

- Needs to attract and retain talent but can dilute founders if poorly designed.

9. Drag-Along Rights

- Permits majority shareholders to compel minority shareholders to sell the company on the same terms.

- Facilitates easier exits and prevents minority stakeholders from hindering deals.

10. Tag-Along Rights

- Grants minority shareholders the right to sell their shares if a majority shareholder sells his.

- Safeguards small investors from missing out on good exit deals.

11. Founder Vesting

- Explores how founders will "earn" their equity after some time.

- Typical structure: 4 years with a 1-year cliff.

- 1-year cliff: Zero equity earned if a founder exits in the initial year.

- Promotes commitment and shields the company from premature exits.

12. Exit Clauses

- Specifies expectations regarding exit events, including IPO, acquisition, or secondary sale.

- It can include timelines and conditions for the start of exit discussions.

- Aligns founders and investors on long-term vision.

13. Redemption Rights

- Permits investors to insist that the firm repurchase their shares after a certain time frame (typically 5–7 years), offering an exit path.

- Essential for funds with a finite lifecycle who need eventual exits.

14. Right of First Refusal (ROFR)

- If a shareholder wishes to dispose of their shares, current investors have the opportunity to purchase them on the same conditions.

- Assists investors in retaining control of ownership transfers.

15. Rights of Information

- Provides investors with access to financial accounts, budgets, board meeting minutes, and KPIs on a periodic basis.

- Allows investors to track company performance and maintain transparency.

Term Sheet Negotiation Strategies

Term sheet negotiation is one of the most critical moments in a startup’s fundraising journey. It defines not just how much capital you raise, but how much control you retain, how future investors treat you, and how you ultimately exit.

Below are the most important strategies, with full details and real-world relevance:

1. Establish Your Negotiation Priorities Upfront

- Prior to going into any discussion with investors, make two lists:

- Non-negotiables: e.g., having founder control, staying away from full ratchet anti-dilution, or limiting board seats.

- Negotiables: These might be the valuation, ESOP growth, or particular veto rights.

- Without set boundaries, it's simple to be manipulated under pressure or agree to harsh terms in order to complete the round.

2. Thoroughly Understand Every Clause (Aside from Valuation)

- While valuation is the star of the show, most term sheet provisions have a big impact on your control, future dilution, and exit proceeds.

- Must-know terms:

- Liquidation Preference: How proceeds are divided in a sale or IPO.

- Participation Rights: Do investors receive their money back plus a profit-sharing?

- Anti-Dilution Provisions: Safeguards investors from being diluted in subsequent rounds.

- Voting Rights: Who has a vote for key business decisions.

- Board Composition: Influences your ability to make independent decisions.

- Founders often lose more to legal technicalities than valuation. Control terms can make or break your company’s future.

3. Don't Over-Optimize Valuation – Optimize the Deal

- A high valuation is not always a win.

- It can lead to:

- Over-dilution of employees

- Down rounds later if your growth doesn’t match expectations

- Over-inflated cap tables, scaring future investors

- Fair liquidation preferences

- Reasonable anti-dilution protections

- Founder-friendly control provisions

- Example: A startup that raised $1M at $10M valuation with a 2x liquidation preference exited at $12M—founders were paid $0 after the investor took $2M off the top.

4. Negotiate Post-Money ESOP Adjustments

- Investors usually demand a 10–20% Employee Stock Option Pool (ESOP) prior to investment. They might demand this be established pre-money, i.e., founders only get diluted.

- Negotiate to increase ESOP post-money or proportionate share dilution among founders and investors.

- A 15%-20% pre-money ESOP on a round worth $5M can cost founders anywhere up to $750,000 of equity.

5. Demand 1x Non-Participating Liquidation Preference

- This is the founder-friendly, market standard term.

- Participating preferred is where investors receive their cash back and share in profits.

- Non-participating preferred is where they take one or the other.

- Negotiate for: 1x non-participating preferred. It's fair, market-standard, and aligns investor incentives with startup success.

- 2x or 3x liquidation preferences unless you're in a high-risk space (e.g., biotech) or late-stage transaction.

6. Make Anti-Dilution Weighted Average, Not Full Ratchet

- Anti-dilution protection assists investors in holding on to their equity if the company does another round at a lower valuation.

- Full ratchet: Reprices their shares to the new lower valuation, overly diluting founders.

- Weighted average: Tones down investor protection for founder equity.

- Negotiate for: Weighted average, which is standard in the industry and equitable. ".

- Full ratchet in a down round might provide the investor with 2x equity for an equivalent amount of money. Weighted average caps this at about 1.3 -- 1.4x depending upon the round.

7. Balance the Board of Directors

- The Board of Directors has legal authority over the company, such as hiring/firing the CEO.

- Negotiation Tactics:

- Advocate for founder control in early phases (e.g., 2 founders, 1 investor).

- In subsequent rounds, agree to balanced boards (e.g., 1 founder, 1 investor, 1 independent).

- Defend against: Investors asking for multiple board seats upfront. That causes loss of control before you've grown.

8. Leverage Legal Counsel and Financial Advisors

- Never negotiate a term sheet by yourself.

- Engage:

- A startup attorney with VC experience

- A cap table specialist or CFO if necessary

- Analyze term sheets

- Model dilution scenarios

- Identify red flags buried in "boilerplate" language

- Cost of missing this: Founders have unwittingly relinquished veto power, IP rights, or equity due to unclear or technical terms.

9. Generate FOMO (Fear of Missing Out) Among Investors

- If interested by multiple investors:

- Provide a definite deadline to sign

- Polite mention of other interest without revealing names

- Be cautious not to provide exclusivity before terms are matched

- When investors sense competition, they're likely to rush, inflate valuation, or enhance terms.

10. Be Honest, Transparent, and Long-Term Focused

- Term sheet negotiation is not a fight; it's an alignment test. Smart investors need and desire transparency.

- Describe your long-term vision

- Clearly articulate what winning looks like for you

- Make your position on exit timelines, dilution tolerance, and governance clear

- Remember: The greatest term sheets are those that create a long-term, high-trust partnership—more than a quick win.

Common Mistakes Founders Make (And How to Avoid Them)

Avoiding common pitfalls can save your company in the long run:

- Focusing Only on Valuation: A high valuation might look good, but aggressive liquidation preferences or board control could hurt you more than a lower valuation with cleaner terms.

- Ignoring Liquidation Preferences: Investors may get paid before founders in an exit—sometimes even 2x their investment. Know what’s standard and what’s not.

- Overlooking Anti-Dilution Clauses: Full ratchet anti-dilution can destroy founder equity in down rounds. Push for weighted average protection instead.

- Accepting Harsh Vesting Schedules: Make sure you're not pushed out too early or losing equity for performance hiccups.

- Not Getting Legal Help : Never sign a term sheet without a startup-focused lawyer reviewing it.

Final Thoughts: Read Before You Sign

A term sheet may not be legally binding, but it carries enormous weight in shaping the future of your startup. It’s the framework upon which formal agreements are built and investor relationships begin.

Rushing through it or overlooking key clauses can lead to dilution, loss of control, or unfavorable exit terms down the line.

Before you sign, take the time to understand every detail, consult legal counsel, and ensure the terms align with your long-term vision.

A well-negotiated term sheet doesn’t just secure funding—it protects your startup’s future.

"Sign the term sheet with your eyes wide open—because what you agree to now shapes everything that comes next."