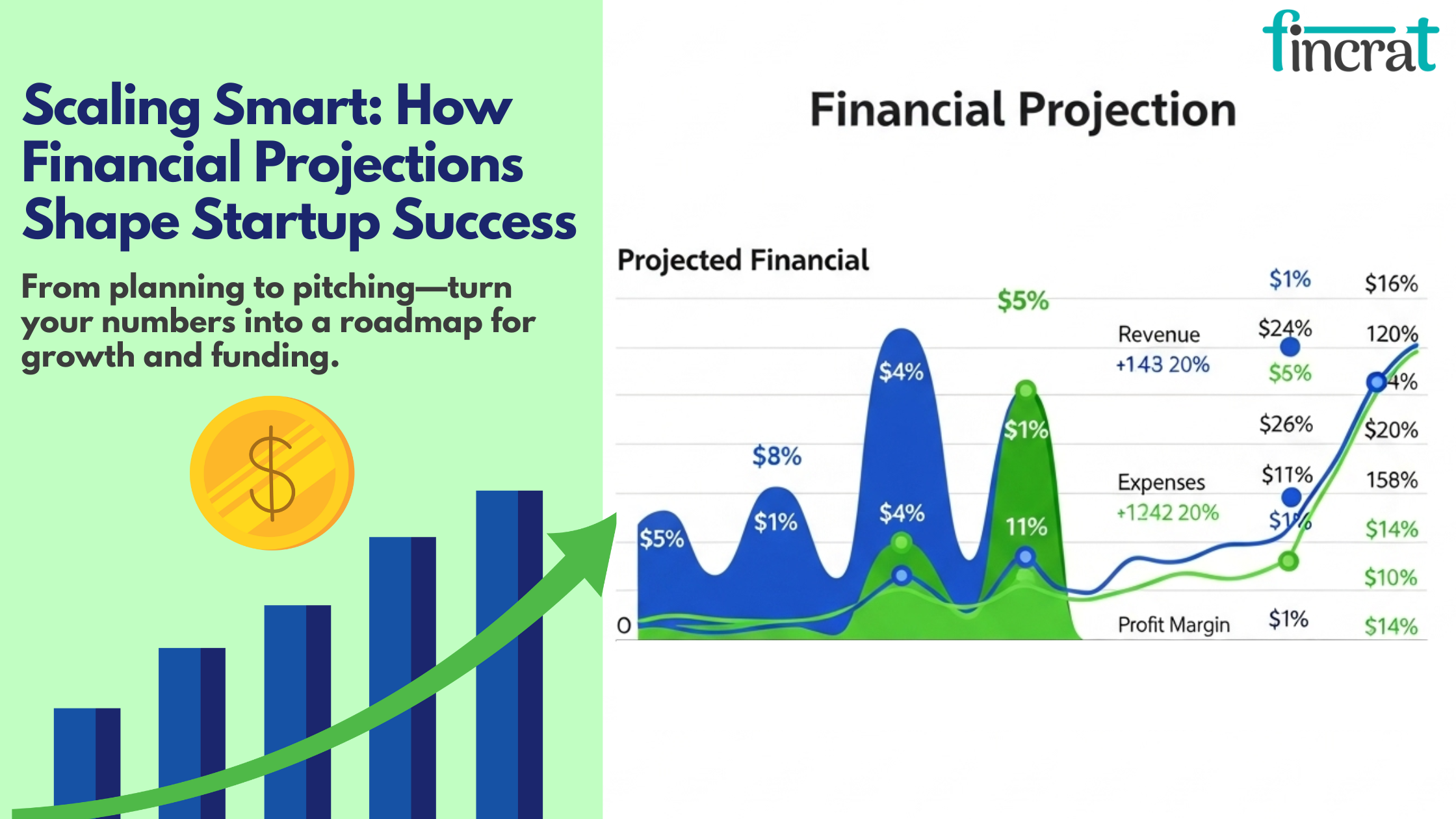

Scaling Smart: How Financial Projections Shape Startup Success

From planning to pitching—turn your numbers into a roadmap for growth and funding

Startups are built on bold ideas, but investors, founders, and teams all want one thing: clarity on where the business is headed. That’s where Financial projections come in. They serve as a blueprint for planning, growth, investment, and survival—especially in the early stages.

Whether you’re bootstrapping or pitching to VCs, accurate projections help you answer the tough questions:

- Where is the business going?

- How fast will it grow?

- What resources are needed?

- How do we manage risks and scale smart?

This blog walks through how startups use financial projections for strategic success and how you can create your own from the ground up.

How Startups Use Financial Projections to Plan for Growth

Financial projections are critical planning tools for startups. By projecting future financial results, they enable entrepreneurs to make better-informed decisions, raise funds, and monitor progress. This is how startups utilize them for planning:

- Setting Clear Goals: Financial projections assist startups in setting realistic and quantifiable goals. They establish projected revenues, expenses, and profits, serving as a reference point to monitor performance and make changes accordingly.

- Attracting Investors: Investors are interested in seeing strong financial projections before investing. By presenting a well-defined plan to grow and make returns, startups can prove their business feasibility and persuade investors to come on board.

- Budgeting and Resource Allocation: With financial projections, startups can budget their resources appropriately. They know where they need to spend and where they can cut back, putting each dollar to its best use.

- Risk Management: Financial projections identify areas of potential financial risk, including cash flow deficiencies or excessive costs. This enables startups to anticipate these problems ahead of time and develop plans B.

- Strategic Planning: Financial projections provide startups with knowledge of their financial status and ability to scale, which is essential for strategic planning on issues like hiring, marketing, and growth.

- Monitoring Progress: Financial projections become a monitoring instrument as the startup scales. Measuring actual results against projections enables the team to determine whether they are on course or require a change of strategy.

13 Step-by-Step Guide: How to Create Financial Projections for Your Startup

Preparing financial projections is a very important activity for startups and companies since it assists in predicting future revenues, expenses, and profits.

Below is a step-by-step, comprehensive guide to assist you in preparing realistic and accurate financial projections:

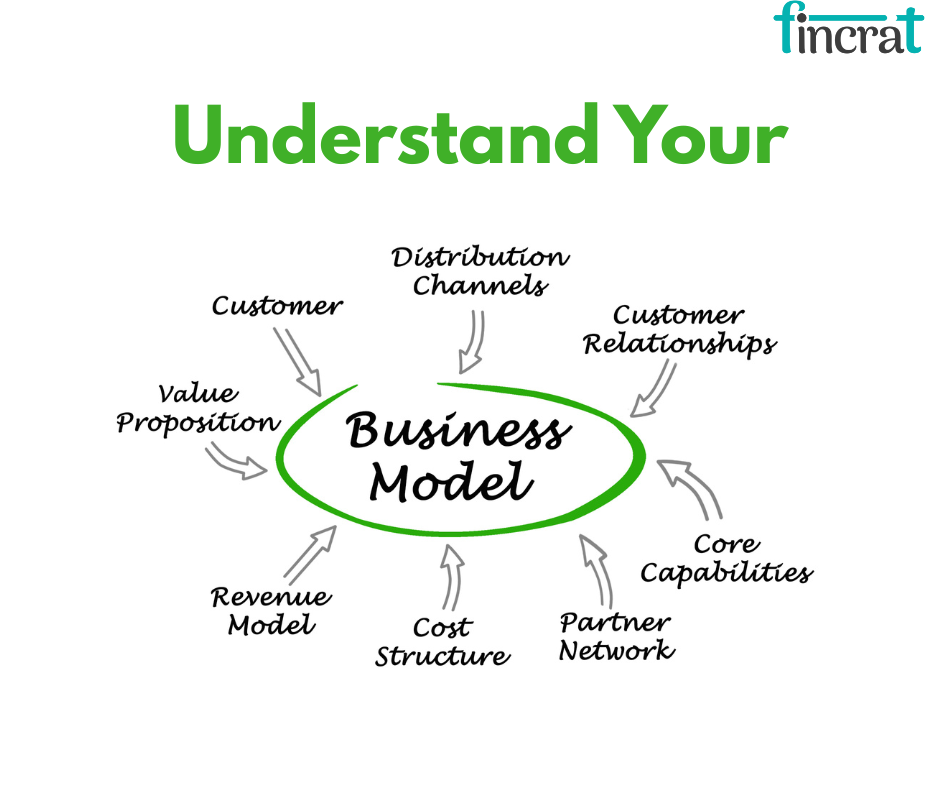

1. Understand Your Business Model

- Prior to jumping into the numbers, it's also important to know your business model.

- That is, recognize how your business creates revenue (e.g., product sales, subscription fees, advertising, etc.) and the cost associated with that.

- Recognizing your model will inform your projections and allow you to create realistic forecasts.

2. Accumulate Historical Data (If Possible)

- If your company is already in operation, begin by analyzing historical financial information. Examine your previous sales, expenses, and cash flows.

- This will provide a good starting point for making future projections.

- If you are a startup, you will have to use industry averages and assumptions.

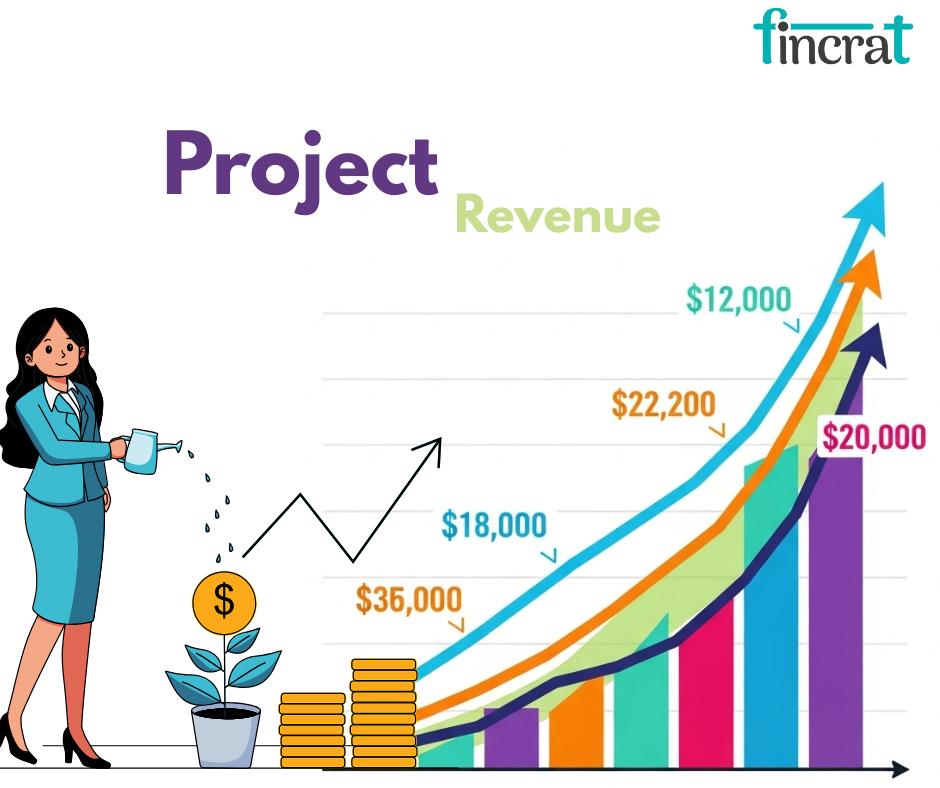

3. Project Revenue

- Begin by projecting your revenue.

- This is typically calculated by projecting the number of customers, average price per product or service, and the rate of growth over time.

- You can project revenue on a monthly, quarterly, or yearly basis.

Account for considerations such as:

- Customer acquisition rates

- Market trends or seasonality

- Pricing initiatives

- Growth in sales volume

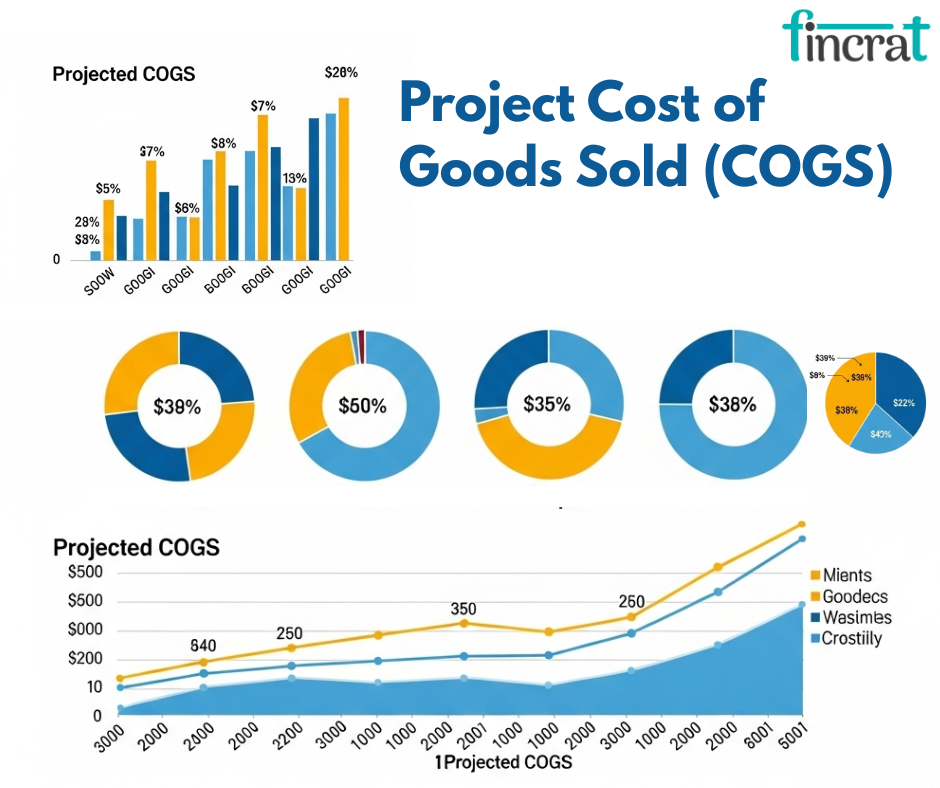

4. Project Cost of Goods Sold (COGS)

- COGS includes the direct costs associated with producing and delivering your products or services, such as raw materials, labor, and manufacturing.

- This is a crucial component for calculating gross profit.

- Make sure to accurately estimate these costs, as they directly impact profitability.

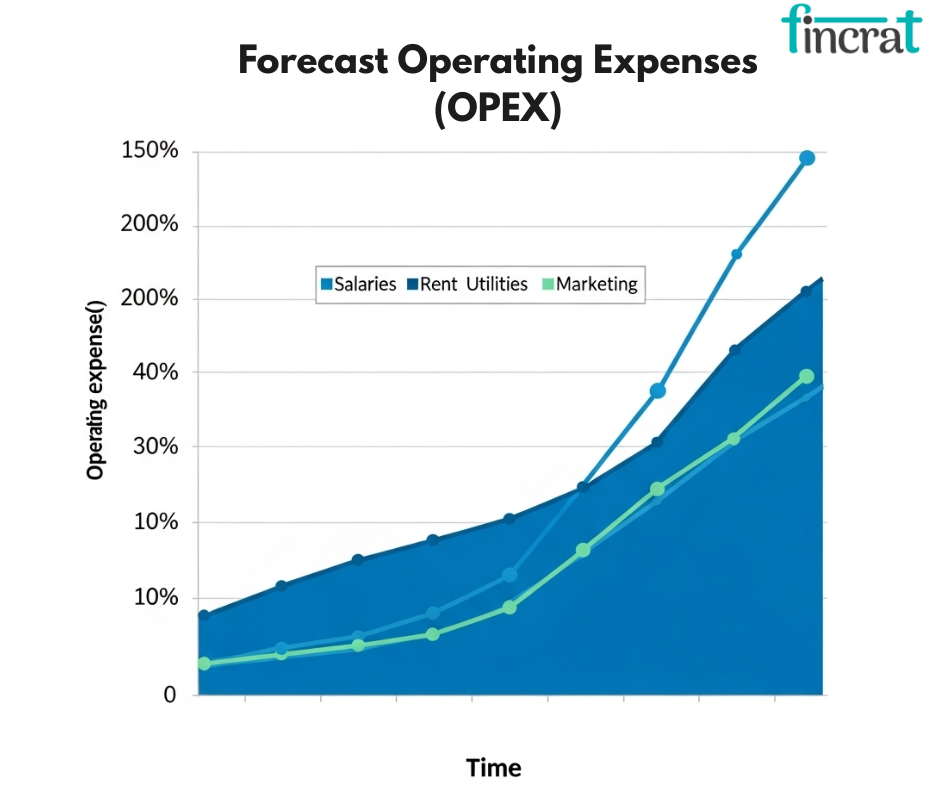

5. Forecast Operating Expenses (OPEX)

- Operating expenses are all of your costs to operate your business, minus COGS.

- They may be salaries, rent, utilities, marketing, and administration expenses.

- It's useful to break your OPEX down into fixed costs (those which don't vary, such as rent) and variable costs (those which vary with business activity, such as marketing expenditure).

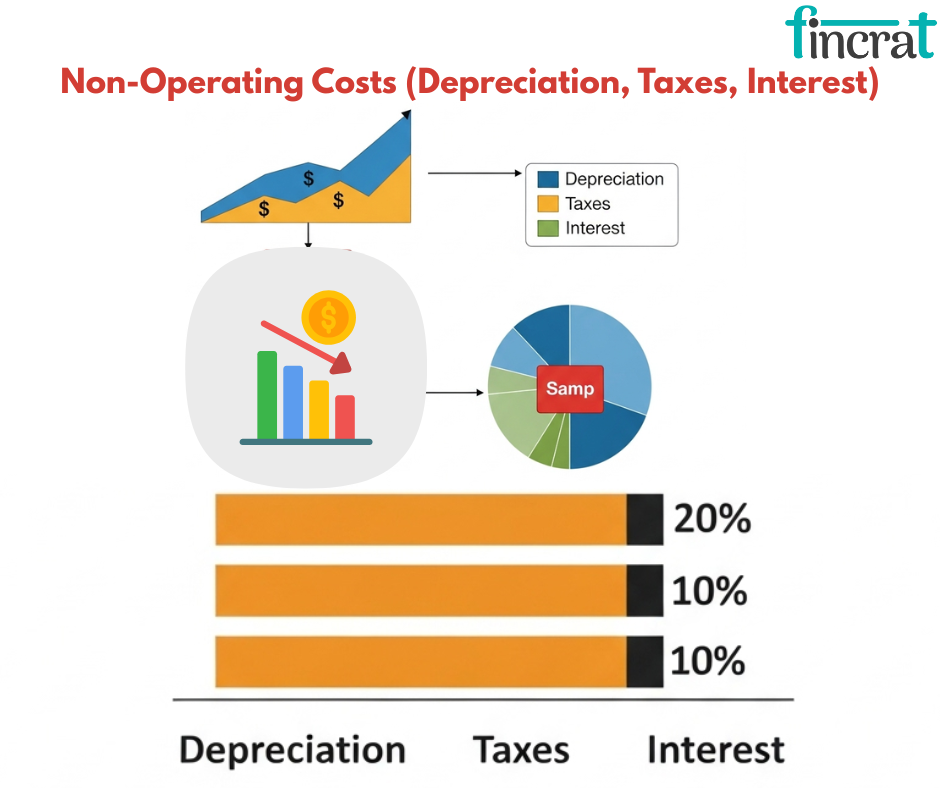

6. Add Non-Operating Costs (Depreciation, Taxes, Interest)

- Some expenses will not be directly applicable to your everyday business activities but must be taken into account, for example:

- Depreciation: Loss in value of long-term assets.

- Interest: If you are carrying loans or credit lines, interest needs to be accounted for.

- Taxes: Budget the taxes your business will need to pay based on estimated income.

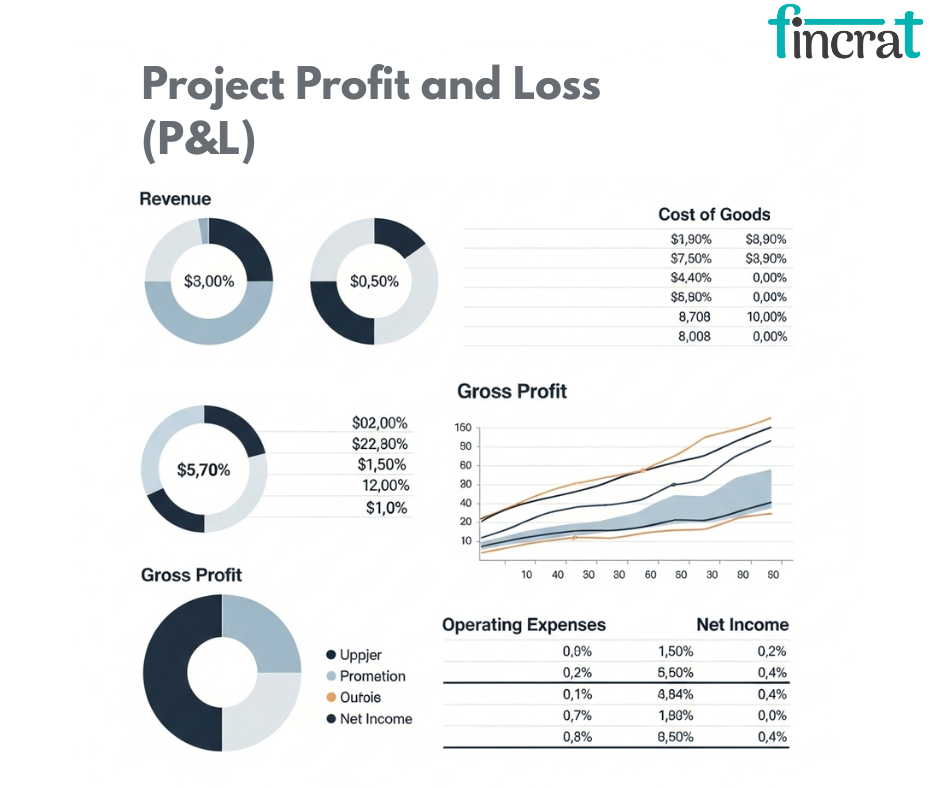

7. Project Profit and Loss (P&L)

- Once you have COGS, revenue, and operating expenses, you can calculate your loss and profit.

- The P&L statement will indicate:

- Gross profit (Revenue - COGS)

- Operating profit (Gross profit - Operating expenses)

- Net profit (Operating profit - Non-operating costs)

- This will give you an estimate of whether your business will be profitable or not.

8. Develop Cash Flow Projections

- Cash flow is important to businesses, particularly startups.

- It illustrates the flow of cash into and out of the business in the future.

- Begin by forecasting cash inflows (such as customer payments) and cash outflows (such as expenses, taxes, and loan payments).

- This will reveal your liquidity and when you will need further funding.

9. Draw up the Balance Sheet

- The balance sheet offers a snapshot of your business's position at a particular moment in time.

- It consists of:

- Assets (what you possess)

- Liabilities (what you have outstanding)

- Equity (the gap between assets and liabilities)

- Your balance sheet will assist you in evaluating the financial health of your business and realizing your capital structure.

10. Verify Your Assumptions

- It's vital to verify your assumptions, particularly if you're a startup.

- For instance, make sure your revenue growth rates, customer acquisition costs, and market trends are realistic and data-driven.

- You can refine your projections using industry research, competitor analysis, or seeking expert advice.

11. Refine Your Projections Over Time

- Your financial projections should be dynamic.

- As your business expands and market forces shift, you'll have to revise your projections.

- Regularly reviewing your assumptions and numbers will keep you on course and force you to make changes when you need to.

12. Use Projections to Secure Funding

- Once you have created your financial projections, they can be used to entice investors or gain loans.

- Investors are looking for a clear indication that lays out the potential for growth and financial feasibility of your business.

- Well-crafted projections offer credibility and indicate that you've considered the financial future of the business.

13. Prepare for Contingencies

- Lastly, make sure to include contingency plans in your financial projections.

- These can account for unexpected challenges, such as changes in the market, operational delays, or unexpected costs.

- Having contingency strategies in place helps ensure that your business can adapt to unforeseen situations.

Common Mistakes Startups Make in Financial Projections

- Overestimating Revenue: It is simple to overestimate. Unrealistic revenue projections are among the most prevalent errors that contribute to startup failure.

- Underestimating Costs: Most startups fail to account for hidden costs such as unplanned expenditure, taxes, or inefficiencies in operations.

- Lack of Flexibility: Forecasting should be updated periodically to conform to new information, trends, and shifts in the business landscape.

- Overlooking Cash Flow: Most startups aim for profitability but neglect cash flow. Ensuring that there is sufficient liquidity to meet everyday expenses is important.

Startup Tools: Excel, Google Sheets, and SaaS Platforms

1. Microsoft Excel

- Microsoft Excel is a most powerful and commonly used tool in the startup environment for financial modeling, budgeting, forecasting, valuation, and cap table management.

- It's extremely flexible and provides sophisticated functionality applicable both to early-stage and growth-stage companies.

- Important Uses for Startups:

- Financial Models (3–5 year projections)

- Break-even and Unit Economics Analysis

- Cap Tables & Equity Distribution

- Cash Flow Statements & Profitability Tracking

- Scenario Planning and Sensitivity Analysis

- For fundraise-ready startups, Excel bottom-up financial models are usually the norm in due diligence.

2. Google Sheets

- Google Sheets is a cloud-based spreadsheet app like Excel but with a focus on real-time collaboration and sharing.

- It's great for startup teams who need to work remotely or share financial information with advisors, consultants, or prospective investors.

Major Uses for Startups:

- Live collaborative cash flow management and budgeting.

- Cap table management with integrations and templates.

- Real-time dashboards via plugins such as Supermetrics or Data Studio.

- Survey data collection and analysis for market research.

- Apply Google Sheets for flexible tracking and collaborative forecasting, and send final models to Excel for investor feedback.

3. SaaS Platforms for Startup Planning and Fundraising

- These are not spreadsheets anymore.

- There are a number of software-as-a-service (SaaS) platforms designed for financial planning, cap table management, investor relations, and pitch deck creation.

- These software assist founders in saving time and enhancing accuracy while getting ready to raise capital.

a. LivePlan

- Purpose: Business planning and forecasting finances.

- Features: Guided business plan templates, automatic financial projections, and comparisons with industry benchmarks.

- Ideal for: Founders developing business plans for banks or seed capital.

b. Causal

- Purpose: Dynamic financial modeling.

- Features: Spreadsheet-like calculations with the possibility of running different scenarios, version control, and stunning data visualizations.

- Ideal for: Startups requiring dynamic modeling as well as real-time investor reports.

c. Carta / Pulley

- Purpose: Cap table and equity management.

- Features: Real-time ownership tracking, fundraising round modeling, 409A valuations, SAFEs, and option plans.

- Best for: VC-funded startups, especially from Seed to Series B+.

d. Finmark (now a part of BILL)

- Purpose: Financial planning and modeling for startups.

- Features: Pre-built templates for revenue, expenses, payroll, runway, and fundraising plans.

- Best for: Founders without extensive finance experience wanting to automate projections.

e. Slidebean

- Purpose: Pitch deck creation and investor readiness.

- Features: Pitch deck, financial, and storytelling templates; integrates AI-powered design tools.

- Best for: Startups seeking aesthetically engaging and investor-relevant presentations.

f. EquityNet / Gust

- Purpose: Investor matching and fundraising.

- Features: Startup descriptions, funding campaigns, investor CRM, document storage.

- Best for: Early-stage entrepreneurs in search of angel or crowdfunding visibility.

g. Y Combinator's Safe Tool / Capbase

- Purpose: Equity and legal documentation.

- Features: SAFE documents, fundraising documents, incorporation tools, equity grants, and compliance tracking.

- Best for: Founders raising early rounds on SAFEs or convertible notes.

Final Thoughts: Financial Clarity Fuels Startup Growth

Financial projections are far more than spreadsheets—they’re your startup’s strategic compass. They guide critical decisions, align your team, and show investors you’ve thought beyond the pitch and into the future.

A solid financial forecast helps you operate with confidence, communicate with clarity, and scale with intention. Whether you're planning your next hire, navigating a product launch, or securing funding, your numbers provide the structure behind every smart move.

For investors, projections are proof that you understand your business model, market dynamics, and growth strategy. They offer more than optimism—they show realism, readiness, and a return-worthy plan.

So plan smart. Pitch smarter. Let your financial story be the reason investors say yes.Because when your projections are clear, your startup moves with direction—and grows with purpose.

"Clear projections turn bold ideas into bankable investments."